YOGA

Share Trading CD

FACTORS AFFECTING REAL ESTATE INVESTMENTS

REAL

ESTATE INVESTMENT

INDEX

1.

Factors affecting

Real Estate Investments

2.

FAQs

3.

Laws

governing Real Estate

4.

Indian

Real Estate Trends 2008

5. Land

records in Karnataka on Web

6.

Agreement to sell

7. How

to buy Agriculture Land

8. For

Non-Resident Indians

9. Taxation and

Real Estate Investment

10. Rent Control

Acts in India

11. Stamp and

Registration

12. Society Laws

13. Details of Home Loans

14. Tips on

Leasing Property

15. Sample Drafts

/ Forms

16. Financial and

Property Calculators

17. Fast

and Vast prosperity of Property in MYSORE

18. The top

Indian Cities

I.FACTORS

AFFECTING REAL ESTATE INVESTMENTS

Real

estate sector in India is on upturn. Research estimates that Indian Real Estate

market is expected to grow from the current USD 14 billion to a USD 102 billion

in the next 10 years. The main growth thrust is coming due to favourable

demographics, increasing purchasing power, existence of customer friendly banks

& housing finance companies, professionalism in real estate and favorable

reforms initiated by the government to attract global investors.

And, that is the undeniable

verdict of a Price Waterhouse Coopers study conducted on the investment

environment in terms of Indian real estate. Ever since the Government of India

gave its stamp of approval to 100% foreign direct investment (FDI) in housing

and real estate, NRIs, overseas real estate

developers, hoteliers, and others have been tracking a path to the

sub-continent. Sensing the business potential for developing serviced

plots, constructing residential / commercial complexes, business centres

/ offices, mini-townships, investments in infrastructure facilities e.g. roads,

bridges, manufacture of building materials, etc., FDI is

flooding in to take advantage of the tremendous real

estate opportunities.

Indian Real

Estate: Growing Potential

The increasing demand for

Indian real estate has not only generated employment, it has also been

instrumental in the growth of steel, cement, bricks and other related

industries. Estimated to be in the region of US $12-billion, real estate

development in

India

is growing by as much as 30% each year. Already, eighty percent of Indian real

estate has been developed for residential space, and 20% comprises of shopping

malls, office space, hospitals and hotels. Fuelled largely due to off-shoring /

outsourcing of BPOs, call centres,

high-end technology consulting and software development and programming firms,

real estate growth in India has great investment prospectives.

Indian Real Estate: Investment

Opportunities

Tax reform measures in the

last few years have ensured real estate in

India

is one of the most productive investment sectors, with money invested in real

estate offering regular returns on investment including appreciating in value.

And, the Government of India by opening up 100% foreign direct investment, and

fiscal reforms like stamp duty and property tax reductions, setting up real

estate mutual funds has turned real estate into a promising investment option.

Already, it has approved

the first Rs. 100-crore FDI project in Gurgaon.

With urban populations expected to grow from 290-million to 600-million by 2021,

housing requirements are expected to top 68-million by 2021, which means

India

's urban housing sector could do with an investment of US $25-billion over a

5-year period. Poised for rapid urbanisation, 3 out

of 10 of the world's largest cities are in

India

. An influx of jobs due to off-shoring / outsourcing has resulted in rising

disposable incomes, increased consumerism, factors responsible for changing the

face of residential and commercial real estate in India.

Wishing to take advantage

of real estate investment opportunities, banks and housing finance companies are

falling over themselves to tie-up with developers or offer project loans at

competitive rates.

Indian Real Estate: Foreign

Direct Investment (FDI)

Recent government policies

have seen to it that inbound FDI for housing, commercial premises, hotels,

resorts, hospitals, educational institutions, recreational facilities, city and

regional level infrastructure, no longer requires prior government approval,

with the exception of the Reserve Bank of India (RBI). It is important that all

inward remittances or issues of shares to NRIs are

reported to RBI within 30-days, and all FDI in the above areas is subject to the

following conditions:

Minimum area for

development under each project is as under: Serviced housing plots, minimum

requirement of 10 hectares. Construction-development projects, minimum built-up

area requirement of 50,000 sq. metres. Combination

project, either of the above two conditions suffices. Investment is further

subject to the following conditions: Minimum capital investment = US$10 million

for a wholly owned subsidiary, and US$5 million for joint ventures with Indian

partners. Further, the funds have to be brought in within six months of

commencing business.

It is not permissible to

repatriate original investment before a period of three years from the date of

minimum capital investment. However, if the investor gets prior approval from

the Government through FIPB, early exit is permitted.

Fifty percent of the

project is to be completed within 5-years from the date of obtaining all legal

clearances. No undeveloped plots can be sold where roads, street lighting, water

supply, drainage, sewerage and other conveniences are not available. Serviced

housing plots can only be sold if the investor has provided infrastructure and

obtained a completion certificate from the concerned local body / service

agency.

Development has to be in

accordance with town master plans, planning norms, standards, and local

bye-laws.

The investor is responsible

for obtaining all necessary approvals, including building / layout plans,

internal / external / peripheral area development, infrastructure facilities,

payment for development and other charges. All development has to be in

compliance with State Government / Municipal / Local Body requirements that are

prescribed under applicable rules / bye-laws / regulations. Further,

Non Resident Indians (NRIs) are

allowed investment under the

Automatic Route

of FDI in the following Housing and

Real Estate Sector:

Services plot

development and construction of built-up residential premises.

Real

estate investment

covering construction of residential / commercial premises including business centres,

offices, etc. Development

of townships.

City /

regional level urban infrastructure facilities, including roads and bridges.

Investment in

manufacture of building materials.

Investment in participatory ventures in (i) to (v)

above

Investment in housing

finance institutions.

Permissible FDI private /

joint / state investment in construction in the export processing zones (EPZS) /

special economic zones (SEZS) is as follows:

100% FDI real

estate investment within Special Economic Zone (SEZ).

100% FDI for developing a township within the SEZ i.e. residential areas,

markets, playgrounds, clubs, recreation centres

etc.

Standard

Design Factory (SDF) building development in existing Special Economic Zones.

SEZ land may be leased or sub-leased to developers as per relevant guidelines

for this purpose.

Full freedom to allocate

developed plots to approved SEZ units on commercial basis including competent

authorities for provision of water, electricity, security, restaurants,

recreation centres etc. along commercial lines.

As you read this, a wide

spectrum of changes are and have taken place in Indian real estate. Various

proposed reforms e.g. removal of tenancy laws, computerization of land records,

correction in taxation structure etc., are ensuring India emerges as a favoured

and profitable destination for real estate developers / investors, both domestic

and international.

Why

real estate investment stands out?

-

Quantum

of investment required is high

-

Investment

horizon is long

-

Dual

returns are available in form of rental income and capital appreciation

|

Investment avenues

|

Returns

|

Volatility

|

Liquidity

|

Risk

|

|

Stock market

|

High

|

Very high

|

High

|

Very high

|

|

Bond/Notes

|

Moderate

|

Moderate

|

High

|

Low

|

|

Bank deposits

|

Moderate

|

Low

|

High

|

Low

|

|

Precious metals

|

High

|

Moderate

|

Moderate

|

Low

|

|

Real estate

|

High

|

Low

|

Low

|

Low

|

The

promising avenues of real estate investment:

-

Offices

-

Shopping

malls

-

Retail

outlets

-

Industrial

warehouses

The

following table gives a list of the factors to be considered in case of

investing in either commercial or residential real estate:

|

Factor

|

Commercial

|

Residential

|

|

Area

|

|

|

|

Location

|

-

An easily

accessible location, high visibility and availability of basic

services (transport, water, electricity, bank ATMs).

|

-

Slightly

away from the hustle-bustle, yet close to shopping areas.

-

Basic services

remain very important.

|

|

Quality of construction

|

|

-

Infrastructure

like water and power supply, security, maintenance services and car

parking space are some of the other issues to consider.

-

But make a

first-hand evaluation and inspection.

|

|

Title

|

|

|

|

Lease status

|

|

|

|

Tenant quality

|

|

|

|

Size

|

|

-

Small,

affordable properties see greater liquidity and genuine user demand.

-

Easier to get

tenants for such houses.

|

|

Yields and appreciation

|

-

Normally, if

you’ve got the area and location right, this won’t give you

worries. But remember to evaluate yields before investing in

commercial property as prices of such properties tend to be a

volatile, and capital appreciation potential is difficult to assess.

|

|

Determining

Real Estate Returns:

Real

estate returns, like stocks, are determined by a combination of two factors:

The

only difference in the two is that in real estate, the lease rentals are fixed,

largely predictable over a period of time and a very significant component of

overall returns. Investors wanting to earn rentals from residential property can

get an average yield of around 6-7 %, and this has been constant for a long

time. Most lease deals have an escalation clause that provides for close to 15%

upward revision in rentals after three years. This would further improve the

returns beyond the existing tenure. For commercial property, the lease rental

yields are even better at 10-13 % and form the basis for investment.

To

arrive at a correct and more realistic estimate of returns, an investor should

consider the following five factors:

-

Maintenance

expenses: While the purchase is a one-time expense, maintenance is an

important recurring cost for preserving the value of your investment,

maintenance expenses are normally Rs 5-20 per sq.ft per month for commercial

property depending on the quality of the property, and this needs to be

factored into yield calculations. Further, each lease contract is structured

differently and a contract may incorporate clauses that create some

financial obligations for the lessor. To arrive at true it is thus important

to look at yields after deducting such expenses.

-

Taxes:

Property tax and taxes on capital gains are the two aspects one needs to

familiarise oneself with and consider when evaluating returns and comparing

them with those on other asset classes. From the tax point of view, the

points to consider while buying are:

-

Cost

of acquisition : Apart from the cost of purchase (agreement value), the cost

of acquisition includes stamp duty, registration charges, legal fees,

brokerage transfer charges payable to a housing society, and payments made

for parking space.

-

Date

of acquisition : For taxation purposes, the date of acquisition is taken as

the date of execution of the purchase deed or the date of possession,

whichever is earlier.

When

renting it out

As

the owner, one will be taxed on the annual value under the head income from

house property, provided one does not use it for business or a vocation. The

annual value will be the actual rent received/receivable. When the actual rent

is less than the expected rent, the income from the property is taxed on the

national rent (expected rent).

-

Interest

on borrowed capital : The interest payable is deductible up to Rs 1.50 lakh

where a loan is taken on or after 1 April 1999 and acquisition/construction

is completed within three years from the end of the financial year in which

the loan is taken. Otherwise, the interest deduction is restricted to Rs

30,000. With effect from 1 August 1998, interest paid for self-occupied

property is eligible for a set-off against salary income for the purposes of

tax deduction at source by the employer.

-

Section

88 : Principal repayments are eligible for a rebate at 15 or 20 % (depending

on the income bracket) of a sum of up to Rs 70,000. This is applicable for

housing loans from specified sources like banks, housing loan companies and

most categories of employers.

When

selling

-

Taxation

of capital gains: Gains from property held for less than three years are

taxed as short-term capital gains (STCG) and taxed at the normal tax rates

applicable to the tax payer. For property held for a period exceeding three

years, the gains will be taxed as long-term capital gains (LTCG) at a

concessional rate of 20%. Further, in case of LTCG, the taxpayer can claim

the benefit of indexation – increase the cost of acquisition against the

inflation index. For property acquired before 1 April 1981 will be taken as

the cost of acquisition.

-

Section

50C : In computing capital gains, this section seeks to tax a notional

amount in the hands of the seller. And so, where the consideration for the

transfer of the property is less than the value adopted or assessed by any

State Valuation Authority (SVA) for determining the stamp duty liability,

the consideration actually received will be substituted by the valuation

adopted for stamp duty for the purpose of computing taxable capital gains.

-

Exemptions

: LTCG is not taxable when it id reinvested in another residential house

property a year before or two years after the date of transfer, or

constructed within three years of the date of transfer. The exemption is

also available if the LTCG is reinvested in specified bonds of NABARD, NHAI,

REC or Sidbi within six months of the date of transfer. The quantum of LTCG

that is exempt is the cost of the new asset or the LTCG, whichever is lower.

Funding

sources supporting investment in real estate:

-

Banks

-

Financial

institutions

-

High

net worth individuals

-

Real

estate mutual funds

-

Security:

When property is rented out, the investor also gets an interest free

security deposit and advance rent. The returns from this also should be

considered. The key to investing in real estate lies in identifying growth

areas and factoring in demand and supply for property.

Tips

while Buying Property

A buyer should exercise utmost caution while buying property in India, be it

for residential or commercial interests. Below is a real estate purchase

checklist that includes tips for property buyers,

discussed under specific categories:

Buying with preliminary research:

It is advisable to identify the property in terms of:

- Nature of property:

- Whether residential/commercial/industrial

- Whether plot of land/flat/floor/commercial space

- Whether the plot of land on which the building is constructed or is

about to be constructed is freehold or leasehold.

- Type of Seller:

Whether individual/partnership/HUF/joint stock company/Association of

persons. Reputation of the builder or seller.

- Potential resale value or the potential rental income of the property.

- Proximity afforded:

Whether close to central business district, entertainment centres hotels,

restaurants, transport hubs, hospitals, market, schools, etc.

- Quality of construction:

Whether structural stability of the building, electrical systems, plumbing

systems, drainage, sanitary fittings, roof, walls, ceilings, floors, paint

work, foundation, doors and windows is sound or not.

Determining the title and interest of the Seller:

- Thoroughly check and satisfy yourself with the marketability of the

property title in terms of whether the owner is the original owner and

whether the title deed is original. Obtain legal opinion through an Advocate

of repute, who can examine the deeds to establish the ownership of the

property by the Seller.

- Similarly, if you are buying a resale flat, ask for the Purchase

Agreement, which is the Agreement between the current seller and the

previous owner and get it scrutinized by an Advocate. He/she will identify

whether the seller is truly entitled to sell the property, whether any

mortgage exists on the property and if it has been paid off and whether

there is any lien on the property.

Retain a copy of this document and also check the original.

- Avoid engaging in negotiations over a disputed property.

Documentation:

- Ask for all the legal documents in original. Check whether a 'No

Encumbrance Certificate' has been obtained to ensure that no mortgage

exists/has been existing on the property. Get a 'No Objection Certificate'

from the Builder/ Society.

- Check for authentic approvals from government agencies like the land

development, planning authority and Income Tax Department. Ask for original

documents and certificates.

- Get a full and true disclosure of all outgoings such as municipal and

other local taxes, taxes on income, water charges, electrical charges etc.

- Take a declaration from the seller on what add-on, if any, he is giving

along with the property.

- Make sure to include every conceivable clause in the Sales Agreement. A

Sale Agreement is the only written evidence of the deal so it should include

everything from payment terms to exact description of the title.

- Understand the finer details of the sale contract properly to arm yourself

with knowledge that shall be beneficial during and after the transaction is

complete.

- Learn about the advantages of Caveat and put one on the title.

- Take care that all the duties that are to be paid on the property like

Stamp duty, Registration fees and taxes is included in the Sale

Deed/Agreement to Sell.

- Ask for any other information and documents as may be prescribed under the

law.

Post Registration Activities:

Subsequent to the registration of the Sale Deed, you should:

- Verify that all the taxes, statutory payments in respect of the property

including power, water charges are paid till date.

- Collect deposit receipts given by power and water supply agencies from the

Seller. Without delay, apply to the power/water supply authorities to

transfer the meters and deposits in your name.

- Ensure that the 'Khata' in the records of the Local Bodies, Gram

Panchayats or the City Corporation is transferred in your name. The original

authorization letter of the Seller and a copy of the new 'khata' have to be

enclosed with the application of transfer.

(A Khata is a document that includes complete details of the land or

property in question for the payment of tax.)

- Get a good idea of the costs of various components like monthly outgoings,

costs of utilities. Do research on the mode of payment and the tenure for

which you will be liable to pay taxes.

- It is useful to obtain periodical Encumbrance Certificates at least once a

year, and make it a routine exercise.

You can use the services of a real estate expert to complement your efforts

in an effective manner, saving time and energy and money.

|

LEGAL DOCUMENTS

Owning a house is an important thing in ones life.

However, one needs to be careful while buying land/house to avoid falling

into legal hassles. A lot of care is needed from the beginning- right from

site seeing till the registration of the land. The legal status of the

land is one of the first issues that you should address before confirming

a property. The first thing is to find out the tenure, legal right of the

holder of the land in government records. The tenure or possession right

could be freehold, leasehold or may be held under a government grant or 'sanad'.

Freehold land is always most preferable. The seller should provide all the

necessary documents to the buyer.

|

| |

- Title deeds

- Tax receipt and bills

- Encumbrance Certificate

- Pledged land

- Measuring the land

- Buying land from NRI land owners

- More than one owner

- Agreement

- Registration

- Changing the title in Village office

|

|

| Title deeds

The first step is to see the title deed of the land

which you are going to buy. Confirm whether the land is in the name of the

seller and that the full right to sell the land lies with only him and no

other person. Don't be satisfied with the Xerox copy of the title deed.

Insist on seeing the Original Deed. Sometimes the seller may have taken a

loan by pledging the original deed. It also needs checking whether the

seller has permitted any entry/access to others through this land and

whether any other fact has been suppressed/left undisclosed by the owner

of the land. It is better to get the original deed examined by a lawyer.

Along with the title deed, the buyer can also demand to see the previous

deeds of the land available with the seller.

Tax receipt and bills

Property taxes which are due to the government or

municipality are a first charge on the property and, therefore, enquiries

must next be made in government and municipal offices to ascertain whether

all taxes have been paid up to date. The owner should also possess the

latest tax paid receipts, which you may inspect. Enquiries should also be

made in various departments of the municipality to ascertain whether any

notices or requisitions relating to the property have been issued and are

outstanding and not yet complied with.

While inspecting the property tax receipt, it can be

noted that there are two columns in the tax receipt. Make sure that the

name entered in the owner's column is correct. The second column will be

for the name of the one who paid the tax. Sometime the owner may not have

the tax receipt with him, in such cases, contact the village office with

the survey no. of the land and confirm the original owner of the land. If

you are buying a house along with the property, then the house tax receipt

should also be checked. Also ensure that the electricity and water bills

are up-to-date and if there any is balance payment to be made, ensure that

it is made by the seller.

Encumbrance Certificate

Before buying any land or house, it is important to

confirm that the land does not have any legal dues. It is available as a

certificate called encumbrance from the sub registrar office where the

deed has been registered, stating that the said land does not have any

legal dues and complaints. The encumbrance certificate for the past

thirteen years should be taken or for more clarification, you could demand

30 years encumbrance certificate to be checked. If you still have anymore

doubts, you can take a Possession Certificate of the ownership of the

particular land, which is available from the village office.

Pledged land

Some people may have taken loan from the bank by

pledging their land. Ensure that the seller has paid back all the amounts

due. Don't get satisfied with the receipt of the payment made. A release

certificate from the bank is necessary to release all the debts over the

land legally. You could buy a land without the release certificate. But if

you want to take a loan in future, the release certificate is a must.

Measuring the land

It is advisable to measure the land before registering

the land in your name. Ensure that the measurements of the plot and its

borders are accurate. You can do this with the help of a recognized

surveyor. This will avoid lots of problems in the future. You could also

take the Survey Sketch of the land from the Survey Department and compare

for accuracy.

More than one owner

In some cases, the land will be owned by more than one

people. So before registering, check if there is more than one owner, and

if there is, get release certificate from the other people involved.

Buying land from NRI land owners

A person staying abroad can also sell his land in India

by giving a Power of Attorney to a third person authorizing him the right

to sell the land on his behalf. But in such cases, the power of attorney

should be witnessed and duly signed by an officer in the Indian embassy in

his province. There is no legal support for Power of attorney signed by a

notary public.

Agreement

Once all the matters, financial/otherwise are settled

between the parties, it is better to give an advance and write an

agreement. This ensures that the owner does not change his word regarding

the cost as well as make a sale to someone else who offers more money. The

agreement should be written in 50 Rs stamp paper. The agreement should

state the actual cost, the advance amount, the time span within which the

actual sale should take place and how to proceed in case of any default

from either parties, to cover the loss. The agreement can be prepared by a

lawyer and should be signed by both the parties and two witnesses. After

signing the agreement if one of the parties makes a default, the other

party can take legal action against him.

Registration

The land can be registered in a sub registrar office,

after preparing the title deed including all the relevant information. You

could get the title deed written by a government licensed Document writer.

Even lawyers can prepare the deed, but the document can only be computer

printed or typed, not handwritten. Handwritten documents can be prepared

by only those who hold the scribe license.

A draft should be prepared before actually writing the

document in stamp paper. Make sure all the details mentioned are accurate.

If there is incorrectness in the document after registering, a secondary

document with the correct details has to be registered and depending on

the incorrectness, the registration expenses will be repeated.

Make sure that the deed is registered within the time

limit mentioned in the agreement. Original title deed, previous deeds,

Property/House Tax receipts, Torence Plan (optional) etc plus two

witnesses are needed for registering the property. Torence plan is a

detailed plan of the property prepared by a licensed Surveyor which will

have accurate details of the measurements including width, length, borders

etc. This plan is needed only in some specific areas. For land costing

more than five lakhs, the seller should submit either his Pan card or Form

Number 16 during registration.

The expenses involved during registration include Stamp

Duty, registration fees, Document writers/ lawyers' fees etc. The stamp

duty will depend on the cost of the property and varies from Municipality

to Corporation to Panchayat. In Panchayat the stamp duty will be 4% of the

cost of the land whereas in Municipality it is 5% and in Corporation 6%.

Two percentages will be charged as the registration fees. Document writers

fees also depend on the cost of the property and varies with individuals.

There is a percentage prescribed by the government as Document writers fee

and they cannot charge more than the prescribed limit.

After registration, the registered document will be

received after 2-3 weeks, from the registrar office.

Changing the title in Village office

The whole legal procedure of buying the property will

be complete only if the new owners name is added in the village office

records. An application can be made along with the copy of the registered

deed to the Village office to get this done

|

_____________________________________________________________________________________

For

EMI Calculation of your repayment schedule / To know your repayment on hosing

loan instalment

CLICK

HERE

_____________________________________________________________

To

know about your Income Tax Saving on account of Home Loan -

CLICK

HERE

______________________________________________________________

For

Tax Planning tool under Housing Loan availment

CLICK

HERE

_____________________________________________________________________________________________

II.

FAQs

GENERAL

- What is meant by

valuation of property?

The valuation process evaluates the market value of the property. Demand and

supply forces operating in the market, as well as other factors like type of

property, quality of construction, its location, the local infrastructure

available, maintenance, are all taken into consideration before the market

value is decided.

- How does property

valuation help?

Typically, if a real estate agent is asked to judge the value of a piece of

property, he would do so based on information of recent sales or purchases

of similar properties in that area.

Though this may give a fair idea of the property’s market value, an

official property valuation would carry more weight. E.g. if you need to use

this piece of property as a security against a loan, the bank’s loan

approval process would be faster and smoother if the property is certified

by an official valuer. Many banks now insist on valuation certificates

before issuing loans using properties as security. The value thus certified

may also have chances of getting a higher amount of loan sanctioned.

Another benefit of official valuation is that it is a useful negotiating

tool when selling the property.

Such certification also becomes essential in situations where the correct

value of the property has a legal bearing—such as, a will statement,

insurance papers, business balance sheets etc.

- What is the

meaning of a property’s market value? How is its stamp duty decided?

The price that a property can command in the open market is known as its

market value. Stamp duty is based on the market value or the agreement value

of the property, whichever is greater.

- What does the term

‘Leasehold Property’ mean?

When a piece of property is given or ‘leased’ to an individual (known as

the ‘Lessee’) for a stipulated period of time, by the owner of the

property (known as the ‘Lessor’), the property is referred to as

Leasehold Property. A certain amount is fixed by the Lessor to be paid as

lease premium and annual lease. The land ownership rights remain with the

Lessor. Transfer of property requires prior permission.

- What does the term

‘Freehold Property’ mean?

When ownership rights for a piece of property are given to the purchaser for

a price, that property is referred to as Freehold Property. Unlike in the

case of leasehold property, no annual lease charges need to be paid and the

freehold property can be registered and / or transferred in part(s).

- Are there any

benefits in converting a leasehold property to a freehold one?

There are several benefits: if you convert the property to a freehold

property, you become a full-fledged owner by getting the sale deed and

having it registered. A freehold property has better marketability and can

be sold, mortgaged or kept for standing security, which cannot be done with

leasehold property.

- Are there any

income tax considerations while transferring newly acquired property?

If the transfer takes place within three years of purchase, the income tax

exemption under Section 54F of the Income Tax Act does not hold good.

- What constitutes

conclusion of sale of a property?

An agreement of sale, coupled with actual possession of the property would

be considered as a conclusion of the sale. Usually, the entire amount is

paid at the time of handing over possession.

RESIDENTIAL

- What is the

difference between carpet area, built-up and super built-up area?

The area of an apartment or building, not inclusive of the area of the walls

is known as carpet area. This is the area that is actually used and in which

a carpet can be laid. When the area of the walls including the balcony is

calculated along with the carpet area, it is known as built-up area. The

built-up area along with the area under common spaces like lobby, lifts,

stairs, garden and swimming pool is called super built-up area.

- When there are

apartments of different sizes in a complex, how is the maintenance charge

calculated?

Legally, the actual area owned by the individual is the basis for

calculation of maintenance charge.

- Why do

Co-operative Housing Societies collect a Sinking Fund?

Co-operative Housing Societies have a statutory obligation to collect a

Sinking Fund. This is done so that in case the building needs to be repaired

or reconstructed in the future, the society has sufficient funds to carry

out the work. The amount to be contributed is decided by the General Body of

the society; it should be at least ¼ percent per annum of the cost of each

apartment, excluding the cost of the land. This fund may be used after a

resolution is passed at the General Body meeting with the prior permission

of the Registering Authority. This could be to carry out reconstruction,

repairs, structural additions or alterations to the building as the

architect thinks is required and certifies.

CORPORATE

- Can corporate

bodies use residential properties as office space?

It is illegal to put residential properties to commercial use. However

service-based industries are allowed to operate from residential areas, on

the condition that they will vacate the property if any complaint is

received from other residential owners.

- Before purchasing

property owned by a company, what aspects should be considered?

Before purchasing property from a company, it is necessary to verify with

the Registrar of Companies that the property is not mortgaged or is not

being used as a security against a loan, otherwise it is not considered a

freehold property.

NRIs

- Do

NRI's require permission of Reserve Bank to acquire immovable property in

India?

No. NRI's do not require any permission to acquire any immovable property in

India other than agricultural / plantation property or a farm house.

- Do

NRI's require permission of Reserve Bank to transfer immovable property in

India?

No. NRI's do not require any permission to transfer any immovable property

in India. Permission is required only in the case of transfering of

agricultural or plantation property or farm house to another citizen of

India NRI or PIO.

- Do

PIO's require permission of Reserve Bank to purchase immovable property in

India for their residential use?

Reserve Bank has granted general permission to foreign citizens of Indian

origin, whether resident in India or abroad, to purchase immovable property

other than agricultural land/farm house/plantation property, in India. They

are, therefore, not required to obtain separate permission of Reserve Bank

or file any declaration.

- In

what manner should the purchase consideration for the immovable property be

paid by PIO's under the general permission?

The purchase consideration should be met either out of inward remittances in

foreign exchange through normal banking channels or out of funds from any

non-resident accounts maintained with banks in India.

- Can

such property be sold without the permission of Reserve Bank?

Yes. Reserve Bank has granted general permission for sale of such property.

However, where another foreign citizen of Indian origin purchases the

property, funds towards the purchase consideration should either be remitted

to India or paid out of balances in non-resident accounts maintained with

banks in India.

- Can

sale proceeds of such property if and when sold be remitted out of India?

In the event of sale of immovable property other than agricultural land/farm

house/plantation property in India by a NRI or PIO, the authorised dealer

may allow repatriation of the sale proceeds outside India, provided all the

following conditions are satisfied: -

• The immovable property was acquired by the seller in accordance with the

provisions of the Exchange Control Rules/Regulations/Law in force at the

time of acquisition, or the provisions of the Regulations framed under the

Foreign Exchange Management Act, 1999;

• The amount to be repatriated does not exceed (a) the amount paid for

acquisition of the immovable property in foreign exchange received through

normal banking channels or out of funds held in foreign currency

non-resident account or (b) the foreign currency equivalent, as on the date

of payment, of the amount paid where such payment was made from the funds

held in non-resident external account for acquisition of the property; and

• In case of residential property, the repatriation of sale proceeds is

restricted to not more than two such properties.

- What

other facilities are available for repatriation?

Authorised dealers can allow remittance up to USD 1 million for any purpose,

per calendar year from balances in NRO accounts subject to payment of

applicable taxes. The limit of USD 1 million per year includes sale proceeds

of immovable properties acquired by the NRI/PIO's while they were resident

in India and held for a period of 10 years and above. In case the property

is sold after being held for less than 10 years, remittance can be made if

the sale proceeds were held for the balance period in NRO account or in any

other eligible instruments.

- Can

PIO's acquire or dispose of immovable property by way of gift?

Yes. Reserve Bank has granted general permission to foreign citizens of

Indian origin to acquire or dispose of immovable properties other than

agricultural land/farmhouse/plantation property by way of gift from or to an

Indian citizen, NRI or PIO.

- Can

NRI's/PIO's rent out the properties (residential/commercial) if not required

for immediate use?

Yes. Reserve Bank has granted general permission for letting out any

immovable property in India. The rental income or proceeds of any investment

of such income is eligible for repatriation

- Can

NRIs obtain loans for acquisition of a house/flat for residential purpose

from financial institutions providing housing finance?

Reserve Bank has granted general permission to certain financial

institutions providing housing finance e.g. HDFC, LIC Housing Finance Ltd.,

etc., to grant housing loans to NRI's for acquisition of a house/flat for

self-occupation subject to certain conditions. The purpose of loan margin

money and the quantum of loan will be at par with those applicable to

housing loans to residents. Repayment of loan should be made within a period

not exceeding 15 years out of inward remittances or out of funds held in the

investor's NRE/FCNR/NRO Accounts.

- Can

authorised dealers grant loans to NRIs for acquisition of a flat/house for

residential purposes?

Authorised dealers have been granted permission to grant loans to NRI's for

acquisition of house/flat for self-occupation on their return to India

subject to certain conditions. Repayment of the loan should be made within a

period not exceeding 15 years out of inward remittance through banking

channels or out of funds held in the investors' NRE/FCNR/NRO accounts.

- Can

authorised dealers grant housing loan to NRI's where he is a principal

borrower with his resident close relative as a co-applicant / guarantor or

where the land is owned jointly by such NRI borrower with his resident close

relative?

Yes. Such housing loans availed in rupees can also be repaid by the close

relatives in India of the borrower.

- What

are the guidelines for acquisition of agricultural land / plantation

property / farmhouse by NRIs and foreign citizens of Indian origin?

All requests for acquisition of agricultural land / plantation property /

farm house by any person resident outside India may be made to The Chief

General Manager, Reserve Bank of India, Central Office, Exchange Control

Department, Foreign Investment Division (III), Mumbai 400 001.

For further information please visit the

FAQ Section of http://www.rbi.org.in

MISCELLANEOUS

- How is a lease

agreement created?

A lease agreement can be reached in either of two ways, depending upon each

case:

•In cases where the lease contract is from year-to-year / exceeding one

year’s rent / reserving yearly rent, then a registered instrument can be

created, which both the lessor and the lessee must execute.

•In cases other than the above, an oral agreement followed by delivery of

possession is considered enough.

- What are the

charges to be paid while gifting property?

When a gift of property is made, a gift deed needs to be made by a lawyer.

Stamp duty on the market value of the property also needs to be paid, as

well as the necessary registration charges.

__________________________________________________________________

III. LAWS

GOVERNING REAL ESTATE

Investing in real estate in India requires

compliance with various laws, some 100 years old and some new. In addition to

Central Govt laws, there are state laws governing real estate transactions and

investment.

The Central laws governing real estate include:

Indian Transfer of Property Act

The Transfer of Property Act governs the

transfer of property by various means. Sales, mortgages (other than by way of

deposit of title deeds) and exchanges of immovable property are required to be

registered by virtue of the Transfer of Property Act. Therefore, all the above

documents must be in writing and registered.

Indian Registration Act, 1908

The purpose of this Act is the conservation of

evidence, assurances, title, publication of documents and prevention of fraud.

It details the formalities for registering an instrument. Instruments which

require mandatory registration include:

- (a) Instruments of gift of immovable

property;

- (b) other non-testamentary instruments which

purport or operate to create, declare, assign, limit or extinguish, whether

in present or in future, any right, title or interest, whether vested or

contingent, to or in immovable property;

- (c) non-testamentary instruments which

acknowledge the receipt or payment of any consideration on account of

instruments in (2) above.

- (d) leases of immovable property from year

to year, or for any term exceeding one year, or reserving a yearly rent

Sales, mortgages (other than by way of deposit

of title deeds) and exchanges of immovable property are required to be

registered by virtue of the Transfer of Property Act. So all the above documents

have to be in writing.

Section 17 of the Act provides for optional

registration. An unregistered document will not affect the property comprised in

it, nor be received as evidence of any transaction affecting such property

(except as evidence of a contract in a suit for specific performance or as

evidence of part-performance under the Transfer of Property Act or as

collateral), unless it has been registered.

Thus the doctrine of part performance dealt

with under Section 53 A of the Transfer of Property Act and the provision of

Section 49 of the Registration Act (which provide that an unregistered document

cannot be admissible as evidence in a court of law except as secondary evidence

under the Indian Evidence Act) together protect the buyer in possession of an

unregistered sale deed and cannot be dispossessed. The net effect has been that

a large number of property transactions have been accomplished without proper

registration.

Instruments such as Agreement to Sell, General

Power of Attorney and Will have been indiscriminately used to effect change of

ownership. Therefore, investors in real estate have to be careful in their due

diligence.

Therfore, establishing “Clear

Title” on your desired Indian Real Estate is more complex and time-consuming

than it is in America or Europe. Please factor this in your due-diligence.

Reference: http://www.madaan.com/realestate.html

|

| |

|

|

|

In Real Estate there are numerous

queries one might have but doesn’t have correct

answers to them. Our experienced professional

executives at Professional Enterprises are totally

geared up to assist you with any queries you may have

about Real Estate. Whether it’s understanding Real

Estate or approaching the market about a product you

would want to sell, purchase, lease, finance &

even invest in. Count on us to assist you with

simplest and the most complex query till you are

satisfied. WE DON’T charge any fees for your

queries.

|

| |

| Getting in touch

with us for Real Estate requirement will help you in

saving valuable time & Real Estate hassles & of

course peace of mind, so do try us. |

| 1).

What are the documents that should be checked before

purchase of a flat under construction? |

| |

| 2).What

are the documents that should be checked before purchase

of an independent house/ flat already built? |

| |

| 3).

What are the documents that should be checked before

purchase of vacant land? |

| |

| 4).

What is a title deed/ title document? |

| |

| 5).

What is a power of attorney deed? |

| |

| 6).Should

a power of attorney be registered? |

| |

| 7).

Can an irrevocable power of attorney deed be revoked? |

| |

| 8).

What is meant by intestate succession? |

| |

| 9).

Can a will, be considered a title deed? |

| |

| 10).What

documents are generally called the title deeds? |

| |

| 11).

What is meant by a sale deed? |

| |

| 12).

What is meant by settlement deed? |

| |

| 13).

What is an Encumbrance Certificate? |

| |

| 14).

What is a patta? |

| |

| 15).

Should the original documents be checked before entering

into a sale agreement? |

| |

| 16).

Should an agreement of sale be registered? |

| |

| 17).

What is lay-out approval? |

| |

| 18).

What are sanctioned plan/ building approval? |

| |

| 19).

What are sanctioned plan/ building approval? |

| |

| 20).

What is meant by purchase of car-parking area? |

| |

| 21).What

is meant by freehold property? |

| |

|

1). What are the

documents that should be checked before purchase of a

flat under construction?

- Title deeds

- Encumbrance certificate

- Revenue record

- Building sanction and

approval

- All the title documents in

respect of the land on which the flat / apartments

is built needs to be checked for minimum period of

past 15 years.

- Encumbrance certificate and

revenue record also needs to be checked. The

building plan with proper sanction from appropriate

authority, together with permission from the

authorities for carrying out such construction-

called the planning and works permit need to be

verified.

|

| |

|

| |

|

2).What are the

documents that should be checked before purchase of an

independent house/ flat already built?

- Title deeds

- Encumbrance certificate

- Revenue record

- Building sanction and

approval

- Lay-out approval

- All the title documents in

respect of the land on which the house is built

needs to be checked for minimum period of past 15

years. Encumbrance certificate and revenue record

also needs to be checked. The building plan with

proper sanction from appropriate authority, together

with permission from the authorities for carrying

out such construction- called the planning and works

permit need to be verified. The lay-out approval for

the land and the property tax paid receipt for the

house needs to be checked.

|

| |

|

| |

|

3). What are the

documents that should be checked before purchase of

vacant land?

- Title deeds

- Encumbrance certificate

- Revenue record

- All the title documents in

respect of the land need to be checked for minimum

period of past 15 years. Encumbrance certificate and

revenue record (patta) also needs to be checked. The

lay-out approval for the land and tax paid receipts

for the vacant land needs to be checked.

- What is meant by title report

/ search on title/ title opinion?

- The report given by a

competent advocate after a thorough investigation,

scrutiny and verification of all available original

and other documents – establishing the transfer of

ownership from the first owner to the present owner.

A history on the ownership of the property is a

title report.

|

| |

|

| |

4). What is

a title deed/ title document?

A deed by, which

the owner has the right of ownership on the property.

This deed could be a registered document or unregistered

in some legally permissible situations. |

| |

|

| |

5). What is

a power of attorney deed?

The document by

which one person appoints another person as an agent to

act on his /her behalf is a power of attorney deed. The

person who appoints an agent is called the principal and

the agent is called the power of attorney agent. |

| |

|

| |

6).Should a

power of attorney be registered?

Whenever a power of

attorney agent is empowered with the power of selling

properties, it is required to have the power of attorney

deed registered. If the power of attorney is for some

other specific purpose, then it not required to be

registered. |

| |

|

| |

7). Can an

irrevocable power of attorney deed be revoked?

Yes. In law there

is nothing like an irrevocable power of attorney. Either

on mutual consent or unilaterally the power of attorney

deed can be revoked or cancelled by the principal. |

| |

|

| |

8). What is

meant by intestate succession?

When a property

owner dies without leaving any document in writing,

informing as to how his/her property has to be shared by

his/her legal heirs after his/her demise is generally

referred to as intestate succession. |

| |

|

| |

9). Can a

will, be considered a title deed?

Yes. The will shall be considered as a title

deed like any other title deed. The will shall be

the title deed for the beneficiaries mentioned in the

will. |

| |

|

| |

10).What

documents are generally called the title deeds?

Any document by which the owner derives right of

ownership over the property is called a title deed.

Well, a title deed includes a sale deed, settlement

deed, release deed, exchange deed, partition deed,

family arrangement, memorandum of understanding and

will. |

| |

|

| |

11). What

is meant by a sale deed?

A document by

which, the right in ownership of a property has been

sold to another person, by the owner of the property.

Sale is always for a certain sum of money agreed between

the seller and the purchaser. Wherever the sale amount

exceeds Rs.100/-, the sale deed has to be compulsorily

registered. |

| |

|

| |

12). What

is meant by settlement deed?

Settlement deed can be executed between the

members of a family only. It is done out of

natural love and affection for the other person. No

money is involved. There are certain restrictions

regarding the persons who can settle and on whom

properties can be settled. |

| |

|

| |

13). What

is an Encumbrance Certificate?

This is a

certificate issued by the Sub- Registrar’s office

under whose jurisdiction the property is situated, upon

an application. This certificate will show all

registered transactions that the property has gone

through. |

| |

|

| |

14). What

is a patta?

This is a record

issued by the government revenue authorities. This

discloses the name of the owner of the property. |

| |

|

| |

15). Should

the original documents be checked before entering into a

sale agreement?

Definitely yes,

wherever it is legally possible, your advocate has to

verify all the original documents. This is a must. |

| |

|

| |

16). Should

an agreement of sale be registered?

An agreement of

sale does not require compulsory registration under law.

However it left to the discretion of the seller and

buyer to register the agreement of sale. |

| |

|

| |

17). What

is lay-out approval?

Extents of land are

put together and divided into housing plots. Such

division requires sanction from appropriate authorities.

Such sanction is called the lay-out approval. |

|

| |

| |

18). What

are sanctioned plan/ building approval?

The proposed

building will be put in the form of a plan and the

appropriate authorities sanction has to be obtained

before construction. This is also called the blueprint. |

|

| |

| |

19). What

are sanctioned plan/ building approval?

The proposed

building will be put in the form of a plan and the

appropriate authorities sanction has to be obtained

before construction. This is also called the blueprint. |

| |

|

| |

20). What

is meant by purchase of car-parking area?

Purchase of car-parking is a limited right

only. This is applicable only when there is covered car

parking. If car parking is marked in the open

space, the open space being common land therefore need

not be purchased. |

| |

|

| |

21).What is

meant by freehold property?

A property where

the owners have absolute rights is called freehold

property. This term also denotes that the property is

not restricted by any limitations on rights.

_______________________________________________________________________

|

|

|

|

Q22.

|

What documents are required while buying

commercial or residential property?

|

| A. |

When buying commercial or

residential property you would need to check for the following

documents:

- Market Trends about prevalent rates of

property in the vicinity and last known transactions.

- Identify the property you wish to purchase.

- Formulate commercial terms.

- Distinguish between terms and conditions of

the contract which are negotiable and those which are fixed e.g.

price, payment schedule, time of completion etc.

- Avail of services of magicbricks.com. List

your requirements with a reputed broker.

- Ask for photocopies of the all deeds of

title related to the property to be purchased. Examine the deeds

to establish the ownership of the property by seller, preferably

through an advocate. Ascertain the survey number, village and

registration district of the property as these details are

required for registration of the sale. Previous encumbrances and

loans, if any, on the property must be cleared before completion

of purchase of the property. The title of the Vendor to the

property must be clear and marketable.

- Finalise commercial terms of purchase of

the property. Ascertain transfer fees, stamp duty and registration

charges to be paid on purchase of the property.

- Ascertain outgoings to be paid for the

property i.e. property

tax, water and electricity charges, society

charges, maintenance charges.

- Request Vendor to obtain, if applicable,

consent, permission, sanction, no objection certificate of various

authorities such as the (a) society (b) the income

tax authority (c) Municipal Corporation (d) the

competent authority under the Urban Land Ceiling and Regulation

Act (e) any other authority.

- Will you require a loan for making payment

of the consideration amount. Ask for a pre-approval letter from

the lending institution.

- Permanent Account Number of Vendor and

Purchaser under Income Tax

laws Payment of stamp duty on the formal

agreement or document for transfer of the property, signing by

both the Vendor and Purchaser and registration

- After payment of the entire sale price,

take over legal possession of the property alongwith documents of

title in original from the Vendor of the property

- Change name of the holder of the property

to the purchaser in the records of the society, electricity

company, municipal corporation, Index II etc.

|

|

| Q23. |

What is

Stamp Duty and who is liable to pay the Stamp Duty, the buyer or the

seller? |

| A. |

Stamp Duty is a tax, similar to sales

tax and income tax collected by the government, and

must be paid in full and on time. A stamp duty paid

instrument/document is considered a proper and legal

instrument/document.

The liability of paying stamp duty is that of the buyer unless there

is an agreement to the contrary. Section 30 of Bombay Stamp Act, 1958

states the liability for payment of stamp duty.

|

|

| Q24. |

What is meant by the market value of the

property and is Stamp Duty payable on the market value of the property

or on consideration as stated in the agreement?

|

| A. |

Market value means the price at which

a property could be bought in the open market on the date of execution

of such instrument. The Stamp Duty is payable on the agreement value of

the property or the market value, whichever is higher. |

|

| Q25. |

Are there

any formalities to be completed or forms to be filled on execution of

the Sales Deed or document of transfer? |

| A. |

Yes. The formalities and forms may vary from

State to State depending on where the property is situated.

|

|

| Q26. |

What are

the permission and papers that one should check with the builder when

buying a flat in a building which is under construction? |

| A. |

When you are buying a flat from a builder in a

building under construction, you have to check the following things:

- Approved plan of the building along with the

number of floors.

- Whether the floor that you are buying is

approved.

- Whether the land on which the builder is

building is his or he has undertaken an agreement with a landlord.

If so, check the title of the land ownership with the help of an

advocate.

- The building byelaws as applicable in that

area and ensure that the builder is building without any violation

of front setback, side setbacks, height, etc.

- Check if the specifications given in the

agreement to sell of the sale brochure match on the ground or not?

- Whether urban land ceiling NOC (if

applicable) has been obtained or not.

- NOC from water, electricity and lift

authorities has been obtained.

|

|

Q27.

|

Who is the appropriate authority for

knowing the market value of the property?

|

| A. |

The Sub-Registrar of the area, in

whose jurisdiction the property is located, is the appropriate authority

for knowing the market value of the property. |

|

| Q28. |

Within what

time period should an agreement/deed have to be registered? |

| A. |

The property agreement should be registered with

the Sub-registrar of assurances under the provisions of the Indian

Registration Act within four months of the date of its execution.

|

|

| Q29. |

What constitutes completion of the sale?

|

| A. |

The transfer of a flat is concluded

when you have an sale deed/ agreement for sale coupled with actual

possession. Generally, in all cases the entire amount is paid

simultaneously with the handing over of physical possession and signing

of the transfer documents. |

|

| Q30. |

What is

meant by leasehold and freehold properties? |

| A. |

Leasehold properties (plot/built-up) are those in

which perpetual leasehold has been granted by the title paramount in

favour of the lessee. In such properties, the title paramount, i.e.

President of India acts through DDA, L&DO, Leasehold properties

are not freely transferable. Depending upon the covenants of the lease

deed, prior permission of the lessor (DDA/ L & DO) is required to

transfer the property.

Freehold properties are those where title paramount has conveyed the

property in favour of the purchaser by conveyance/sale deed with no

restriction on the right of the holder of the property to further

transfer the property. Record of ownership of the freehold property

can be ascertained from the office of the sub-registrar. It can be

transferred by registration of sale deed.

|

|

| Q31. |

What formalities need to be completed by

foreign citizens of Indian origin for purchasing residential immovable

property in India under the general permission?

|

| A. |

They are required to file a declaration in for

IPI and with the central office of Reserve Bank at Mumbai within 90

days from the date of purchase of immovable property or final payment

of purchase consideration, along with a certified copy of the document

evidencing the transaction and the bank certificate regarding the

consideration paid.

|

| |

|

| Disclaimer:

The information contained herein should be used for reference only and

We are not be responsible for any claims arising out of the use of any

information displayed herein. |

Owning a house is an important thing in one’s life.

However, one needs to be careful while buying a property to avoid falling into

legal hassles. Before buying a land, a number of checks need to be done to

confirm that the land has a clear and marketable title. The legal status of the

land is one of the first issues that should be addressed before confirming a

property.

Title deeds

The first step is to see the title deed of the land,

which you are going to buy.

* Confirm whether the land is in the name of the seller

and that the full right to sell the land lies with only him and no other person.

* It is better to get the original deed examined by a lawyer. This is to check

details like whether the seller has permitted any entry/access to others through

this land and whether any other fact has been suppressed/left undisclosed by the

owner of the land.

* Along with the title deed, you can also demand to see the previous deeds of

the land available with the seller.

* In some cases, more than one person may own the land. So before registering,

check if there is more than one owner, and if there is, get release certificate

from the other people involved.

Conveyance Deed or Sale Deed

A sale agreement is a document by which the title of

property is conveyed by the seller to the purchaser. Here, conveyance is the act

of transferring ownership of the property from a seller to the buyer. This

document will help you ascertain whether the property, which you are buying, is

on land belonging to the society/ builder/development authority in which the

property is located.

Tax receipt and bills

Property taxes, which are due to the government or

municipality, are a first charge on the property and, therefore, enquiries must

next be made in government and municipal offices to ascertain whether all taxes

have been paid up to date.

* Inspect whether the latest tax paid receipts have been

paid.

* Enquire with various departments of the municipality to ascertain whether any

notices or requisitions relating to the property are outstanding.

* If you are buying a house along with the property, then the house tax receipt

should also be checked.

* Also ensure that the electricity and water bills are up-to-date and if there

any is balance payment to be made, ensure that it is made by the seller.

Encumbrance Certificate

Before buying any land or house, it is important to

confirm that the land does not have any legal dues.

* Obtain a certificate called encumbrance from the sub

registrar office where the deed has been registered, stating that the said land

does not have any legal dues and complaints.

* You can check the encumbrance certificate for the past thirteen years or could

demand verify the 30 years encumbrance certificate.

Pledged land

Some people may have taken loan from the bank by

pledging their land.

* Ensure that the seller has paid back all the amounts

due.

* Ask for a release certificate from the bank, which is necessary to release all

the debts over the land legally.

Measuring the land

It is advisable to measure the land before registering

the land in your name. Take the help of a recognized surveyor to ensure that the

measurements of the plot and its borders are accurate. You could also take the

survey sketch of the land from the survey department and compare for accuracy.

Purchasing land from NRI landowners

A person staying abroad can also sell his land in India

by giving a Power of Attorney to a third person authorizing him the right to

sell the land on his behalf. In such cases, the power of attorney should be

witnessed and duly signed by an officer in the Indian embassy in his province.

Power Of Attorney

Power of Attorney is the power given to an agent by the

principal to execute several acts and deeds for and on behalf of the principal.

Stamp duty payable depends on the nature of power given.

When ‘power’ is given in respect of a number of acts

in a number of transactions it is called General Power of Attorney. It is always

advisable to hold a registered GPA while registering an immovable property in

order to give better title to the property.

When ‘power’ is given in respect of a particular act

pertaining to one transaction it is called Special Power of Attorney.

Agreement

Once all the matters, financial/otherwise are settled

between the parties, it is better to give an advance and write an agreement.

This ensures that the owner does not change his word regarding the cost as well

as make a sale to someone else who offers more money.

* The agreement should be written in Rs.50 stamp paper.

* The agreement should state the actual cost, the advance amount, the time span

within which the actual sale should take place and how to proceed in case of any

default from either parties, to cover the loss.

* The agreement can be prepared by a lawyer and should be signed by both the

parties and two witnesses.

* After signing the agreement if one of the parties

makes a default, the other party can take legal action against him.

Stamp Duty

It is tax, similar to sales tax and income tax collected

by the Government, and must be paid in full and on time.

* A stamp duty paid is considered a legal document

and such gets evidentiary value and is admitted as evidence

in courts.

* Stamp duty is a State subject and hence would vary from state to state.

* When an agreement is to be stamped, it needs to be unsigned and undated one

may execute the agreement only after the Stamp Office affixes stamps on the

agreement.

Registration

Registration is the process of recording a copy of a

document, transferring the title in immovable property to the office of the

Registrar. It acts as proof that a transaction has taken place.

* A draft should be prepared before actually writing the

document in stamp paper. Registration is done after the parties execute the

document.

* The agreement should be registered with the Sub-Registrar of Assurance under

the provisions of the Indian Registration Act, 1908 within four months from the

date of execution of the document.

* Make sure all the details mentioned are accurate.

* Original title deed, Previous deeds, Property/House Tax receipts, etc plus two

witnesses are needed for registering the property.

* The expenses involved during registration include Stamp Duty, registration

fees, Document writers/ lawyers fees etc.

* Make sure that the deed is registered within the time limit mentioned in the

agreement.

* Stamp duty should be paid prior to the Registration.

Changing the title in Village office

The whole legal procedure of buying the property will be

complete only if the new owners name is added in the village office records. An

application can be made along with the copy of the registered deed to the

Village office to get this done. Purchase of property is a lifetime investment.

A lot of care is needed from the beginning- right from site seeing till the

registration of the land. Ensure that the documents of title are scrutinised for

marketability with due care by an experienced advocate.

__________________________________________________________________

Questions

on House Purchase

Information

on House, Owner & Broker

|

House

Address (with area name, pin code)

|

|

|

House

facing direction

(fencing gate and main gate)

|

|

|

Landmark

near Ukkadam, to locate this house

|

|

|

Total

Land Area (In Sqft)

|

|

|

Total

buildup Area (In Sqft)

|

|

|

Pending

work / Notes ?

|

|

|

Any

local problems for this house (mafia – gunda – dada) – ask the

locality. (No offense)

|

|

|

Owner

Still alive ? (No offense)

|

|

|

House

Sold by Owner or his children / grand children's ? - For signature

reasons

|

|

|

Owner

Name

|

|

|

Owner

Address & Contact Number

|

.

|

|

Purpose

of sale

|

|

|

Broker

Name

|

|

|

Broker

Address & Contact Number

|

|

|

Builder

Info

|

|

|

Building

Completed Date

|

|

|

|

|

Land

& House Information

|

Pathram

& Patta photo copy (xerox)

– Please collect a photo copy of these documents

|

Yes

/ No

|

|

Legal

Opinion

1)

Verify orginal Pathram & Patta

2)

Any Legal Case on Land or Building

3)

Villangam Certificate / Document

4)

Sale history of the property, and the current owner info from the

government department or lawyers legal opinion

|

Yes

/ No

|

|

Building

License approval , Layout approval, Sub division approval - documents

|

Collect

Document photo copy and document numbers – check weather the building

has be built accordingly

|

|

Property

tax paid till

|

|

|

House

tax paid till

|

|

|

Government

Municipal Approved Area ? (for water, drainage, electricity, telephone)

|

|

|

Rain

water harvesting Required / Available

|

|

|

House

Fencing Required / Available ?

|

|

|

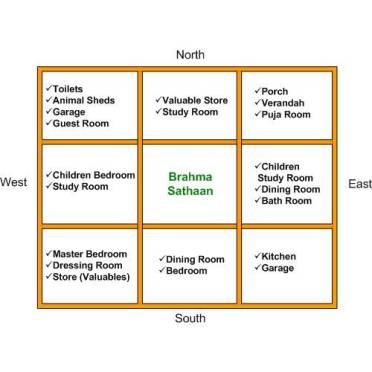

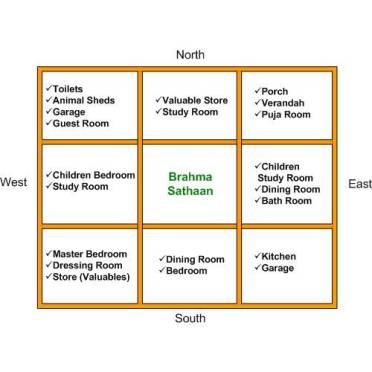

Vaastu

Shastra (Feng Shui) Verified ?

|

Yes

/ No (to self verify – please check the picture)

|

|

Number

of rooms (excluding 1 hall and 1 kitchen and toilets)

|

|

|

Number

of toilets (Indian, western)

|

|

|

Number

of floors

|

|

|

Number

of stairs ?

|

|

|

House

is built using pillars or with out pillars (kallukattu – simple stone

concrete)

|

|

|

How

many floors can be raised further

|

|

|